How to invest in stock market Philippines? Did you know for as low as P1,000 “every Juan” can start investing in the stock market?

Curious, serious, but don’t know where or how to start? Here’s a simple guide on how to start investing in the Philippines. As a beginner, the secret is to be teachable, curious and serious to learn. Along the way, you’ll know if it’s for you. Read more to know the pros and cons and the benefits too.

Your Selling Stock is Messing Up? You Need Help!

Ginee Omnichannel allow you to automatically sync every stock from all of your online stores. It’s faster way to helps you profit!

Why Invest in the Stock Market?

How to invest in stock market Philippines 2021? Stocks are the shares of ownership in a corporation. You get to be a shareholder of a company if you buy stocks listed in the Philippine Stocks Exchange (PSE).

How to invest in Jollibee stocks? Let’s say you buy stocks from Jollibee, MegaWorld, and SM Investment Corp. You become a shareholder of those companies. In other words, you become a co owner of the company. So, why invest? As the company grows, then your shares also grow and receive profits. But if they experience losses, you experience them, too.

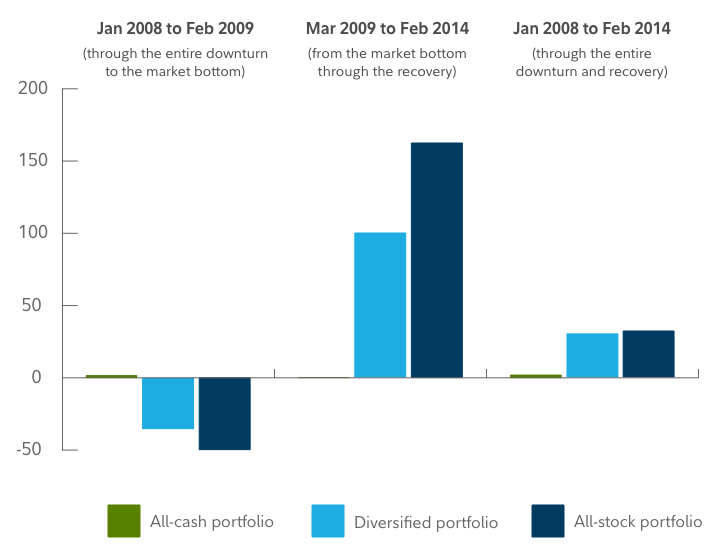

Stocks offer the most growth potential compared to short-term bonds or other investments. The rates are higher than the rates that most banks offer on an annual basis. So, if you’re doing it long term, your money grows for the long term.

If you start investing in stocks, you can gain more than that and even have a 30% if you’re into day to day trading. You can manage to grow your investment portfolio every year at 8%, and for long term stocks. A safe estimate, though and of course, better than 0.10%.

Read also: List of Newest Stock Management Feature

Two Approaches in Investing—Short-Term vs Long-Term

Day Trading and Quick Gains (for Short-Term)

If you want quick gains, you can open an account online on COL Financial. You can start buying the stocks that you believe in most and trade daily. As a beginner, you’ll have to learn the basics of technical analysis, get real time updates on prices. It would be best if you learned the nooks and crannies of trading.

Don’t Know How to Set Up Digital Ads? Don’t Worry!

Set up Google, Facebook, TikTok Ads, and more with Ginee Ads. The best part is you can do all of this in one place. Check it out now!

Buy Stocks and Diversify the Portfolio (for Long-Term)

Another approach is to study, research and more research. Research before buying the stocks from companies you think will do well for the long-term. Let’s say 5 to 10 years from now.

Long-term means you are willing to let your hard-earned money to “sleep” for that long. The longer you hold them, the better the gains. But again, you need to understand that investing in the stock market involves risk.

You may want to start buying blue-chip stocks. These stocks have higher liquidity and are easy to trade. They are not accompanied by high risks and are considered safe investments compared to other stocks.

How Can You Make Money in Stocks?

Capital Appreciation

Each stock has a corresponding price. Capital appreciation happens when the price of your stock increases. It’s the difference between the price you paid when you bought both your shares and the current market price.

For example, if you buy stocks from Company A at P200.00 After three days, the price went up to P230.00 then your capital appreciation is P30.00. The realised gain of P30.00 only happens when you sell at P230.00 If you hold it, let’s say after 30 days, then it went up for about 270.00, your capital gain is P70.00.

If the price decreases, then you sell it at P200.00, you have no gains.

Dividends

Corporations issue dividends to shareholders. These dividends represent the earnings of the company to be shared, either via cash or additional shares of stocks.

Read also: What are Social Media Marketing Benefits for Your Business?

How to Invest in the Stock Market

Where to invest in the stock market? There are hundreds of licensed brokers accredited by PSE. You can choose the type of service you want based on your convenience and preference.

1) Choose Your Broker

How to invest in stocks for beginners with little money? Stocks are shares of ownership in a corporation. The stock market is a place where stocks are bought and sold. The Philippine Stock Exchange (PSE) is the corporation that governs our local stock market. People buy or invest in stocks to benefit from a company’s tremendous value potential over time.

2) Online (COL Financial, First Metro and Phil Stocks)

The online stock brokers directly communicate with the customers online. Clients execute the orders, and they have direct access to the market’s information. COLF has been receiving great reviews as the best and easy to use the online platform as a stockbroker. You can start funding your account for as low as P1,000.00 as of this writing.

Want to Put Digital Ads Everywhere Without Hassle?

Get the 360 digital marketing experience via Ginee Ads. Put your ads anywhere at any time, do them all in just one place!

3) Traditional (Use a Licensed Broker or Salesman to Handle Account)

These are assigned licensed salespeople to handle your account and they take orders via phone call.

4) Open Your Stock Market Brokerage Account

You can avail COL Financial’s entry-level account at P1,000. You can download the forms here. Fill up the forms and attach them with the requirements and send them over via mail. If you want quick verification of documents and approval, you can drop by at their office in Ortigas.

5) Fund Your Account

You can fund your account via online banking. Once approved, COL will provide the bank details so you can fund your account. You’re given a grace period of three months to fund your account for activation.

You can either fund your account via bank deposit or personally deposit the money to your broker’s office.

6) Place Your Order: Buy or Sell, Via Online or Phone Call to Your Stockbroker

Again before you buy or sell, you may want to read more on the companies you want to buy stocks from. For starters, you can read The Intelligent Investor by Benjamin Graham and Increase your Financial I.Q. by Robert Kiyosaki.

For beginners, you can buy stocks on a regular schedule with the same amount of funds. Do this if you’re going to invest for the long term. It’s the Peso Cost average where you grow your money in the long run.

7) Monitor or Track Your Investments

Investing is an ongoing process as you may want to track and monitor the progress of your stocks. If you choose an online stock brokerage like COL, you can log in to their website. You can access all the information and data you need.

Conclusion

Investing in stocks is never risk free. But if you start young and early, you get to enjoy the growth of your money if you’re going to do it for the long term. Always stay curious, be a learner and explore as much as you can as you invest.

Are You Having Difficulties Managing Online Sales?

- Do you have trouble duplicating products while selling them through many channels?

- Do you wish to find a more efficient approach to manage orders when selling on multiple platforms online?

- Do you have problems keeping track of inventory when selling on many platforms?

- You have no idea how to deal with customers when there are a lot of them?

Now is the time to use Ginee Philippines to relieve managerial stress. Ginee is an online sales management software that uses the Omnichannel paradigm to make it easier for merchants to sell multi-channel products. When you use Ginee, you will receive the following benefits:

Do You Want to Manage Multiple Marketplace Just by Single Person?

Of course you can! You can handle multiple stores from all marketplace just by single dashboard. Cut your Business’s cost, and Boost your Efficiency at the same time.

- Adding new goods, bulk editing, and updating all sales channels at the same time simplifies product management.

- From the time you get the order, arrange for shipment, and print the labels, to the time the buyer receives the items, you can effortlessly manage orders.

- Inventory synchronization is used to manage and update inventory across all online sales channels.

- Managing consumers allows you to have a deeper understanding of your customers by looking at payment history, ordered products, and purchasing patterns.

Sign up for a free 7-day trial today so you don’t miss out on great features at Ginee.

Ginee

Ginee

30-12-2021

30-12-2021