Shopee loan instalment? Online shopping is nowadays. In fact, there’s an increase within the number of online sellers in addition to websites that provide platforms for sellers to showcase their products.

Who Qualifies for Shopee SPayLater?

Shopee instalment without credit card? One of the foremost visited online platforms now could be Shopee. It caters to thousands of Filipinos by carrying products from school supplies to book organisers, to small furniture and even appliances or gadgets. a bit like the other shopping platform, Shopee requires payment before your item is going to be delivered to your step.

Your Selling Stock is Messing Up? You Need Help!

Ginee Omnichannel allow you to automatically sync every stock from all of your online stores. It’s faster way to helps you profit!

There are several ways to obtain your purchases: cash on delivery, mastercard, payment through remittance centres, and bank transfer. Despite the wants, there are instances once you want to avail of an instalment scheme to make payment easier for you.

Paylater Shopee Philippines? SPayLater could also be a feature wherein qualified buyers have the selection to buy for now and pay later or apply for an instalment credit of up to a few months for his or her Shopee purchases. SPayLater incorporates a processing fee of 0-2% per transaction amount and monthly interest ranges from 1-5% for items.

SPayLater may be a Billease Shopee Buy-Now-Pay-Later payment method. you’ll make a procurement immediately and procure it next month, or as instalments across some months.

Individuals eligible to use the SPayLater feature of Shopee may check their account if said service is obtainable. To do this, they need to open their Shopee app so attend their profile page by clicking the “ME” button.

SPayLater is Shopee’s Buy-Now-Pay-Later payment method. you’ll make a sale immediately and procure it next month, or as instalments across some months. you furthermore may have the selection to open up your repayment to 2 months, 3 months or 6 months (selected users) with alittle processing fee of 1.25% of the total order amount.

Does Shopee Accept Instalment?

Shopee loan for sellers? SPayLater may be a feature wherein qualified buyers have the choice to shop for now and pay later or apply for an instalment loan of up to three months for his or her Shopee purchases. SPayLater contains a processing fee of 0-2% per transaction amount and monthly interest ranges from 1-5% for items.

Before you’ll be able to pay by instalments, you should add it as a payment method to your Shopee account. you’ll do so on Shopee App by visiting the Me tab > Account Settings > Linked Payment Methods > +New mastercard Instalment. Fill in your mastercard details and Submit.

You’ll be redirected to the bank/card provider’s page for confirmation. Fill within the One-Time Password (OTP) sent to your mobile number when prompted and Submit. When you’re testing an eligible product, you’ll then choose mastercard Instalment > select your preferred Instalment Plan > Confirm.

Shopee instalment Philippines seller allows all the sellers to sell their high value product during a more cost-effective way from 22nd June 2021. Looking at the worth of the merchandise, buyers can value more highly to buy with a 6 months / 12 months / 18 months instalment package with 0% instalment fees.

Go to the Shopee instalment bdo app and begin shopping. raise cart those items you wish to shop for. Once you’re done, attend your cart and click on try. Click Payment Option.

Don’t Know How to Set Up Digital Ads? Don’t Worry!

Set up Google, Facebook, TikTok Ads, and more with Ginee Ads. The best part is you can do all of this in one place. Check it out now!

How Do I Activate my Instalment on Shopee?

How to increase Shopee paylater limit? In order to spice up your buyers’ buying experience and boost your sales, you’ll converge for an instalment buying to sell your high-value products in an exceedingly more cost effective way.

Betting on the price of the merchandise, buyers can now enjoy 6 months, 12 months or 18 months (Maybank only) of 0% instalment payment using their Maybank or Public Bank credit cards.

Generally, you’re unable to select which products are entitled to the payment once you’ve signed up because the instalment buying payment channels are implemented on all of your products. Here some steps for you on a way to activate your instalment on Shopee:

Step 1: Log-in to BillEase Account.

You need to log in to BullEase account. If you don’t have an account you’ll be able to register first.

Step 2: Gcash Top Up

In the BillEase page or app, click Top Ups. Then click Gcash Top Up.

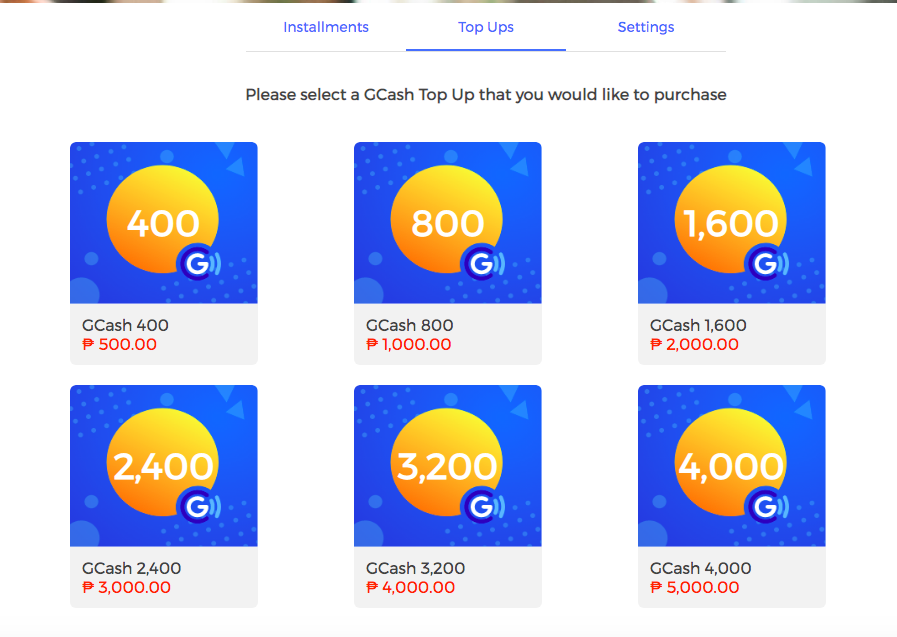

Step 3: Amount

Click the highest up amount you wish to buy. Available amount is between P400 and P4,000

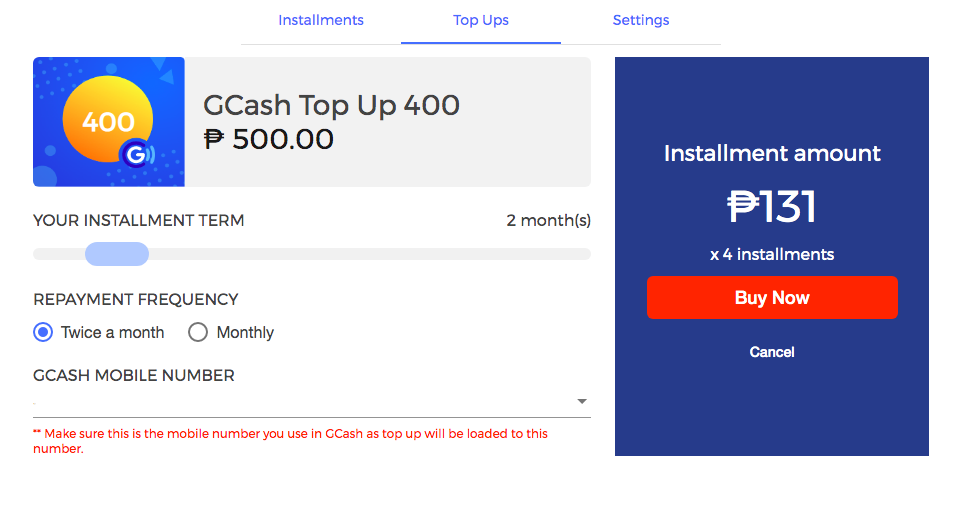

Step 4: Payment Terms

A new window will appear once you click your required amount. Navigate the button for your instalment term and repayment frequency. As you navigate, you’ll also see on the correct screen the number you have got to pay. Input your Gcash number. Then click Buy Now.

Read also: How Can You Be an Online Seller in Shopee Philippines?

Want to Put Digital Ads Everywhere Without Hassle?

Get the 360 digital marketing experience via Ginee Ads. Put your ads anywhere at any time, do them all in just one place!

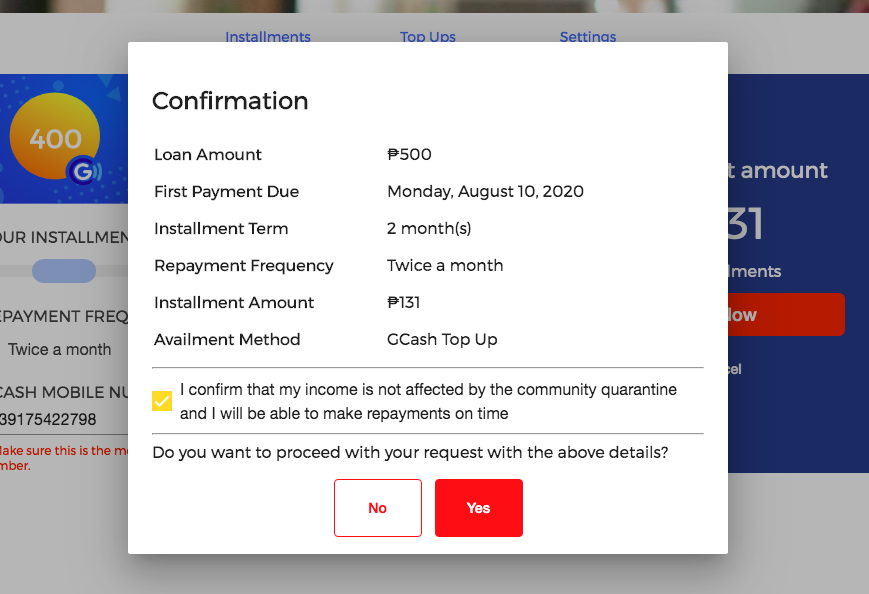

Step 5: Loan Confirmation

A new window will appear after clicking Buy Now. Take time to review the small print. If you’re ready, tick the checkbox then click Yes.

Step 6: Finalise Your Loan

Once you confirm your loan, the window indicating your Loan Contract additionally as Disclosure Statement will appear.

Tutorial SPayLater

How to qualify for Shopee pay later? A revolving credit is extremely different from a mastercard, but in both cases, that may do instalment payments. within the case of an open-end credit credit, that may directly land the precise amount from the bank which will charge us with the precise amount monthly.

Activate SPayLater by visiting the Me tab > Activate Now > Fill within the One-Time Password sent to your registered mobile number > Continue > Upload your valid government ID details and other required information > Start Facial Verification > Ok.

Read also: Things That You Need To Know About Shopee Philippines

Conclusion

Shopee pay later review? Shopee is the latest player within the growing BNPL scene, with many fintech startups deep within the water. While it trails another giant, Grab which launched its own PayLater feature back in 2019 and recently enhanced it with 0% instalment options, SPayLater is already present in two other markets: Indonesia and Thailand.

SPayLater is managed by SeaMoney, the fintech arm of unicorn startup Sea, the parent company of Shopee additionally to the popular gaming company, Garena.

Do You Want to Manage Multiple Marketplace Just by Single Person?

Of course you can! You can handle multiple stores from all marketplace just by single dashboard. Cut your Business’s cost, and Boost your Efficiency at the same time.

From its website, SeaMoney looks to also dabble in other traditional banking services, including consumer cash loans still as financing for sellers on Shopee.

Subject to regulatory approval, these could likely be introduced in Philippines moreover, considering Shopee is rumoured to own an interest in one in every of the five digital banking licences in Malaysia and has already secured one for Singapore.

Multi-channel Stock Management Is Messy? Use Ginee Omnichannel Now!

Ginee Philippine‘s stock management feature will help you manage your multi-channel stock easily, quickly, and automatically on the marketplace. It ensures that your marketplace product stock is updated in real-time and resolves overselling issues. Try this amazing feature for free now!

Ginee

Ginee

26-1-2022

26-1-2022