When setting up a business, you need to register with several government agencies to get business permit depending on the type of business you have. What is business permit? Then, how to get business permit online? Here is the explanation on how to apply business permit online.

Read also: How to Start an Online Business?

Guide to Get Your Business Registered

Here is how to apply business permit online Philippines.

Register Business Name in DTI

Your single proprietorship needs to be registered with DTI to give it a legal identity and obtain the right to use your business name. Remember that registering a Business Name (BN) is not a license to operate a business. Business name registration and fee payment on Manila business permit online can be done at bnrs.dti.gov.ph.

Get Barangay Clearance

How to apply for business permit in the Philippines, prepare all the requirements, such as: two valid IDs, address proof, Contract of Lease (if rented) or Certificate of Land Title (if owner), and Certificate of registration from DTI. After preparing all of them, go to the barangay where your business is located. Complete the business permit application form, submit it with other requirements and apply to license your Barangay Business Clearance.

Acquire Mayor’s Permit

To acquire a Mayor’s Permit, prepare the business permit requirements, such as:

- Two valid IDs.

- Address proof, Contract of Lease (if rented) or Certificate of Land Title (if owner).

- Certificate of registration from DTI.

- Barangay Business License.

Then, go to the city office where your business is located. Complete the form, submit it along with other requirements, and apply for your Mayor’s Permit.

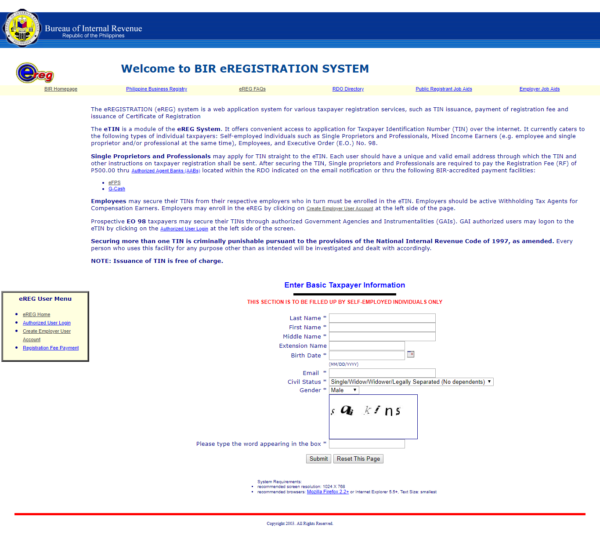

Register in BIR

Every business enterprise must register with the BIR for tax purposes. The Bureau will give your business its own Tax Identification Number (TIN) and the right to print receipts, invoices and the others.

Your Selling Stock is Messing Up? You Need Help!

Ginee Omnichannel allow you to automatically sync every stock from all of your online stores. It’s faster way to helps you profit!

How to Register Your Business in DTI

How to register business in DTI is explained as below.

Read also: Profitable Online Business Ideas 2021 in the Philippines

Prepare and Confirm Availability of Business Name

First of all, prepare your business name. According to DTI, your business name (BN) refers to any name, beside your real name. You will use it related to your business. Next, confirm the availability of your business name. After preparing your business name idea, look for them on the DTI website and check availability for use.

Fill Out the Online Registration Form

If your business name is available, you can fulfill and complete the DTI online registration form through the Business Name Registration System (BNRS). Please note that the reference code will be provided to you because you will use it in all transactions with BNRS.

Pay the Registration Fee

After completing your business permit online application form, follow the instructions and pay the required application fee within 7 calendar days of business permit application. You can pay the fee via PayMaya, GCash, or credit/debit card.

| Territorial Scope | Fee |

| Barangay | Php 200 |

| City/Municipality | Php 500 |

| Regional | Php 1,000 |

Download Your Certificate

After confirming your payment, your business name will be successfully registered. Access the Transaction Inquiry, accept the Terms and Conditions and enter the reference code provided when you have completed the registration form.

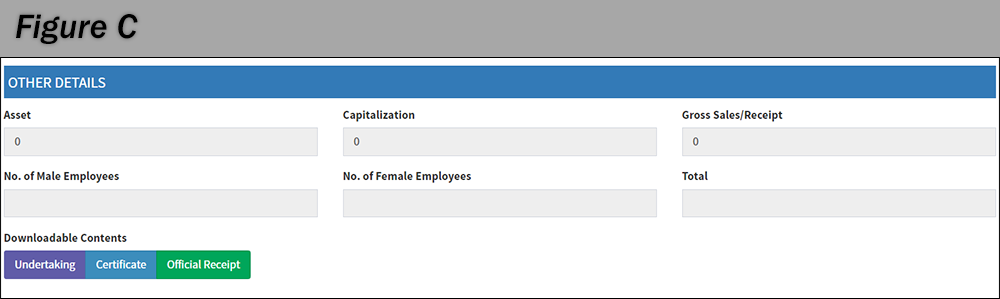

How to Register Your Business in BIR

It is different to register BIR for online business and online freelancers. Here is how to get business permit for online selling and freelancer.

For Online Business

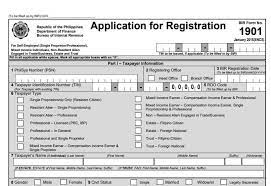

For online businesses like online stores (single proprietors), prepare the requirements, such as the following and then, complete 3 copies of form BIR 1901.

- DTI Registration Certificate.

- Barangay Business Clearance.

- Mayor’s Permit.

- Certificate of Land Title (if owned) or Certificate of Lease (if the place is rented).

- Government issued ID (Passport, Driver’s license, Birth Certificate, etc.

After that, pay the registration fee. How much is business permit computation 2022? The application fee is Php 500 and Php 30 for loose DST or Proof of Payment of Annual Registration Fee (ARF). You can pay the registration fee at banks recognized by BIR.

Accredited banks will provide you with BIR payment form. Submit it to the bank along with your Documentary Stamp Tax on Lease. After payment, send your RDO copies of the BIR form payments and other required documentation.

For Online Freelancers

For online freelancers, prepare the requirements:

- Tax Identification Number (TIN).

- Occupational Tax Receipts (for unlicensed professionals).

- Professional Tax Receipts (for licensed professionals).

- Government-issued IDs.

- NSO Birth Certificate.

The Revenue District Office (RDO) may request additional requests such as copies of contracts with customers or Barangay Clearance.

For those who do not have a TIN, you must complete and submit 2 copies of form BIR 1901. This is the first thing you need to secure before taking the next step. If you have worked in the past and had a TIN, you still need to complete the BIR 1901 form and update your details. Now you must declare that you are “self-employed”.

Additionally, you must also complete BIR form 1905 to transfer your TIN registration. Change your registered address and forward it to the appropriate RDO where you conduct business and have jurisdiction over you.

Next, do payment of the Certificate of Registration (COR) fee. The COR registration fee is Php 500. Complete form BIR 0605 and pay the fee to any Authorized Agent Bank in your RDO. Always keep your receipt and a copy of the form. After payment, prepare 3 copies of the completed form and the receipt provided.

The BIR does not require freelancers to submit a DTI permit, but you may need to secure an OTR. Cities have different requirements when issuing OTR. You can get an OTR from your town hall and the most basic request is a copy of a contract from an existing project or client.

If your city does not issue an OTR, you can go directly to your RDO and ask for more information about what to do instead. Prepare a copy of your OTR to submit to the RDO if your city provides a copy.

Want to Put Digital Ads Everywhere Without Hassle?

Get the 360 digital marketing experience via Ginee Ads. Put your ads anywhere at any time, do them all in just one place!

Submit All the Requirements to Respective RDO

Both online business and freelancer, submit your application by visiting your respective Revenue District Office (RDO). The RDO has jurisdiction over you and where your business is located.

Request Your Certificate of Registration (COR)

Some RDOs may require you to attend filing tax seminar before you can claim your COR. Make this clear to RDO after paying your registration fee. When claiming your COR, make sure you also get a “Ask for Receipt” sign.

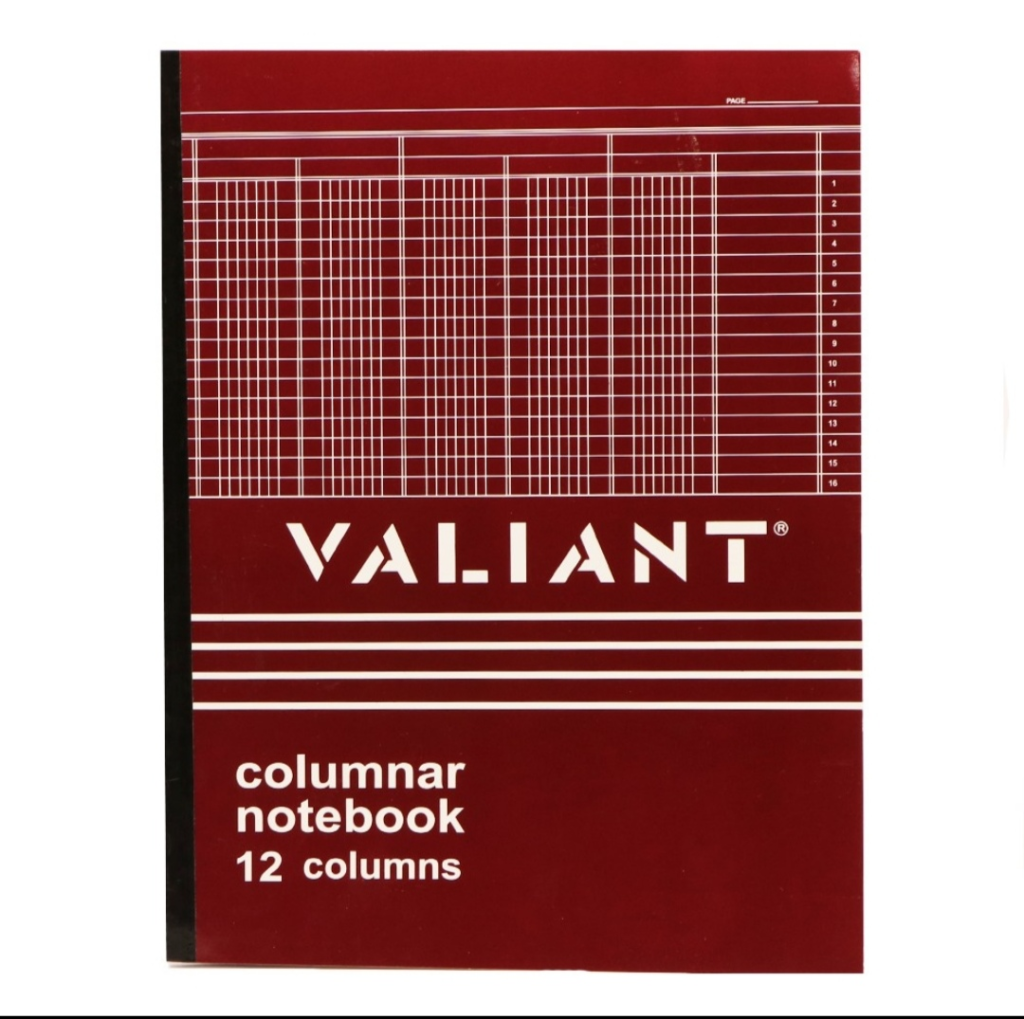

Buy and Register Your Account Books

An account book is where you keep the original record of all your business transactions. There are 3 types of account books:

- Manual Books of Account: This includes journals, ledger or columnar books in which you manually document (handwrite) your trade transactions.

- Loose-leaf Books of Account: This also includes journals and ledgers, but they are printed instead of handwriting. Bookkeeping through Microsoft Excel (spreadsheets) can also be considered a separate account book.

- Computerized Books of Account: A computerized bookkeeping program or system is common for businesses with complex operations.

For freelancers, 2 account books are normally required. Register your account book by completing and submitting form BIR 1905 with your account book to the RDO where your business is registered.

Do You Want to Manage Multiple Marketplace Just by Single Person?

Of course you can! You can handle multiple stores from all marketplace just by single dashboard. Cut your Business’s cost, and Boost your Efficiency at the same time.

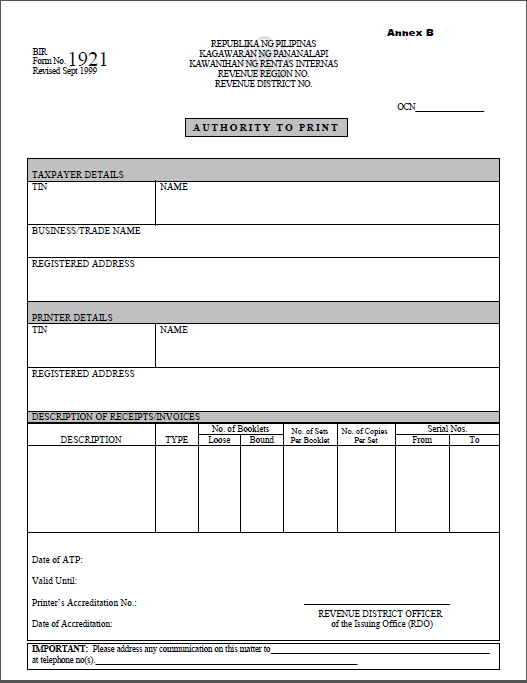

Secured an Authority to Print (ATP)

Bir requires companies with Authority to Print receipts (for service providers) or commercial invoices (for goods sales companies). Complete and send 3 copies of BIR 1906 form to RDO, with a major or additional invoice form and a copy of your COR. It will usually take a week before you can get your ATP.

Once your ATP is obtained, send it to an accredited BIR printer. It usually takes up to 2 weeks to release your official invoice.

Conclusion

After going through all the necessary paperwork to make your online business legal and registered, you can now breathe as you are assured that your business is completely in control and there’s none that can use your business name.

Ginee Philippines

Boost your sales from now on Lazada with Ginee Philippines! As mentioned before, Ginee can help you find the best selling items on Lazada even other marketplaces, plus make your items become one of the best selling ones. Ginee has features like product management, stock, order, promotion, Ginee Ads, Ginee Chat, Ginee WMS, Ginee Fulfillment, and many more. Register Ginee Now and enjoy the benefits of being smart sellers!

Upload Products to Shopee and Lazada Automatically! How?

Ginee product management allow you upload products to all of your online stores from all marketplace just once! Save time, save cost, save energy, join Ginee Now!

Ginee

Ginee

12-4-2022

12-4-2022