Alibaba vs Shopee? Quite unusually, both Alibaba and Sea Ltd. published their latest quarterly results on, after the Chinese giant cut projections and delayed the publication by period earlier in November.

And they do wreak a comparatively grim reading, after it missed targets for 2 straight quarters and slashed its forecasts for the whole FY2022.

Your Selling Stock is Messing Up? You Need Help!

Ginee Omnichannel allow you to automatically sync every stock from all of your online stores. It’s faster way to helps you profit!

While much of the company’s problems are right down to a slowdown in China and therefore the political crackdown on the country’s digital megacorporations by Beijing, the corporate has fared equally poorly abroad.

Alibaba Hits The Ceiling

Shopee owned by Alibaba? Its sales on the mainland are still strong, but appear to have hit a limit. The corporation posted a YoY increase of 33 per cent for Chinese retail but at 126.8 billion RMB, it is 6.7 percent down from the quarter ending in June, when its revenues peaked at 135.8 billion RMB.

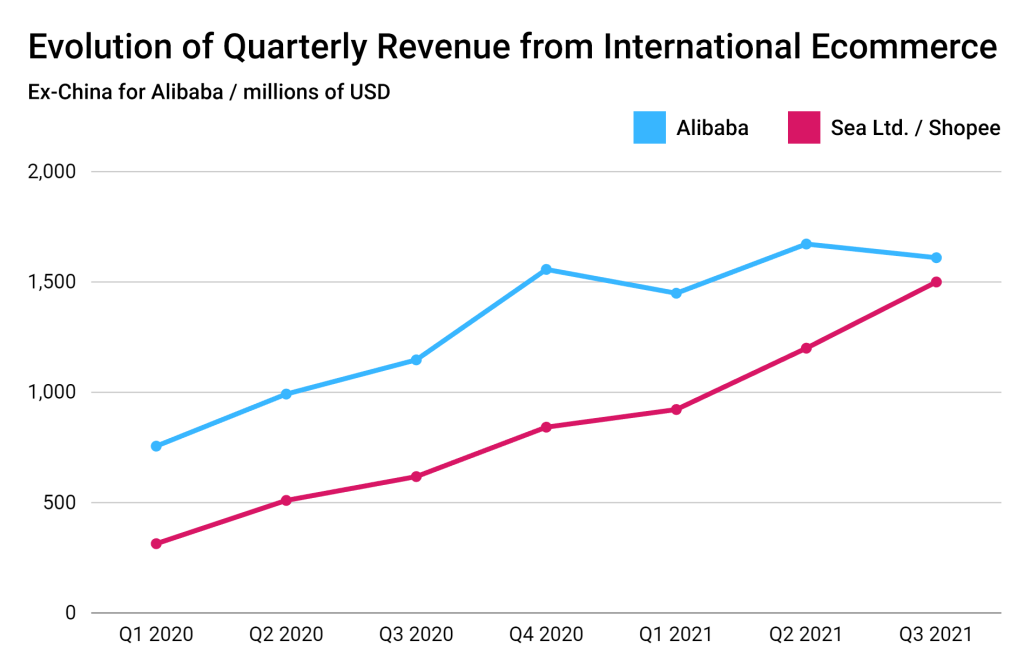

It’s an identical story abroad, with revenue right down to US$1.61 billion from US$1.67 billion within the previous three months, a decline of around 3.6 per cent.

In fact, Alibaba has been at the identical level of around US$1.5 to US$1.6 billion per quarter since the start of 2021, which indicates it’s reached limits to its growth outside China at a time when competitors are making rapid progress.

Meanwhile, Shopee’s parent company, Sea Ltd. has just posted US$1.5 billion in revenue for Q3 2021, up by 134.4 per cent year-on-year and 25 per cent quarter-to-quarter (from around US$1.2 billion in Q2).

Future is Not Without Bumps for Sea

Lazada vs Shopee Singapore? While these results may suggest that the corporation is doing exceedingly well, one can’t forget that its business model relies on the profits generated by the digital entertainment arm of Garena, which offsets a number of the prices incurred by growing Shopee and Sea’s other services.

As you’ll be able to see below, after witnessing a lift in bookings during the pandemic, Garena’s growth appears to be normalising, which can have knock-on effects on Shopee’s growth further.

Should the digital entertainment business suffer a rise in profit margins (heaven forbid), then overall performance of Sea will be hurt quite badly and rapidly because the company keeps losing money in pursuit of market share elsewhere, particularly in e-commerce.

Don’t Know How to Set Up Digital Ads? Don’t Worry!

Set up Google, Facebook, TikTok Ads, and more with Ginee Ads. The best part is you can do all of this in one place. Check it out now!

It still has pretty deep pockets at the instant, given its capitalization, which has skyrocketed within the past two years and currently sits at US$170 billion (with guidance of spill US$200 billion by the likes of Bank of America, Citigroup or UBS).

Thanks to it, it was able to raise nearly US$9 billion within the past year alone and currently boasts around US$11 billion of money in hand.

That said, progressing normalisation of life with Covid-19 around the world is probably going to chill the expansion of digital services, which have received an infinite boost with billions of individuals stuck in their homes during the pandemic.

The immediate future still looks bright, with an expected e-commerce revenue boost of further 51 per cent in 2022, which might bring it to over US$7.5 billion.

That said, gaining a stronger and more profitable foothold in additional developed markets (e.g. in Europe) is probably going to cost the corporate dearly within the coming years, while it’s still competing for market share in Asia and geographical regions.

To handle all of them successfully, it must start turning a profit among its most mature customers and offload the burdens borne by Garena within the past two years.

Shopee market share? Undoubtedly, Sea has used the chance Covid-19 has presented to its absolute maximum, reinvesting everything it could to ride the wave. It’s now about reinforcing these gains and also the next two are likely to point out to us just how stable and lasting Shopee’s presence around the world is.

Read also: Local vs International Shopify Dropshipping Philippines?

Sea vs Alibaba’s Financial Results

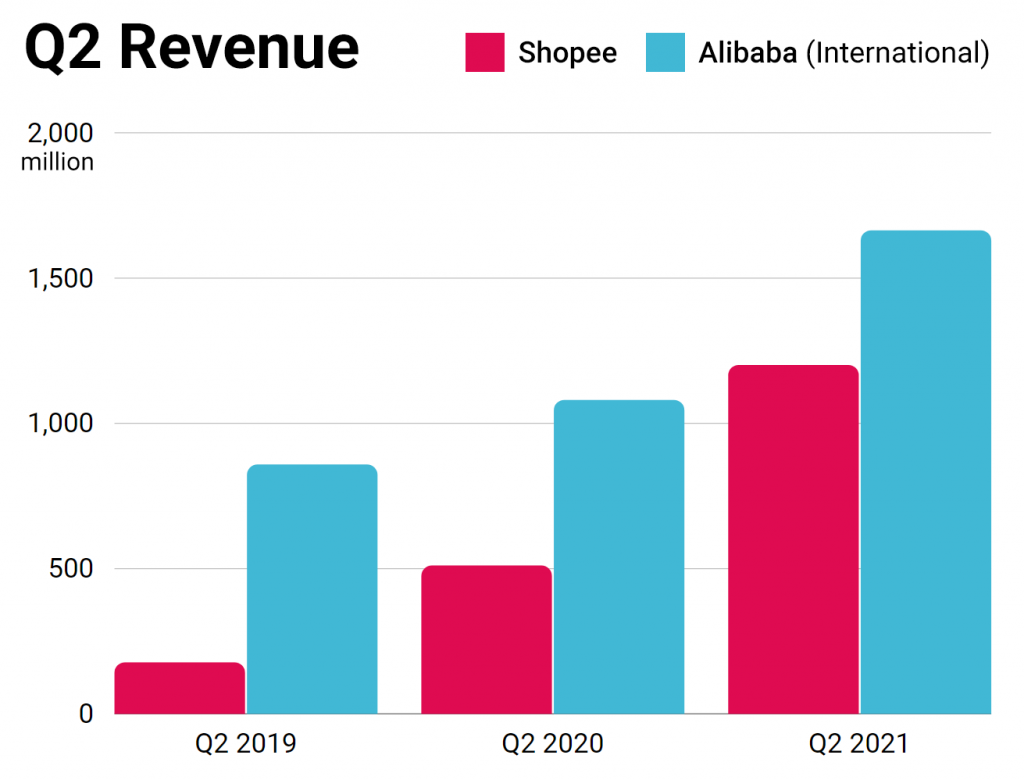

Shopee market share in southeast asia? Sea’s guidance for full year results is estimated at US$4.7 to US$4.9 billion in revenue in 2021, which might already beat Alibaba’s international results during the twelve month 2020.

This gives further credence to the allegation that Jack Ma’s brainchild is failing badly outside of China, struggling to secure a stronger foothold abroad.

At first glance, over 50 per cent in revenue growth year-on-year seems respectable, but not only does it pale compared to its competitors, it’s also just five per cent of the Chinese giant’s annual revenue.

That said, Alibaba remains a great China-first company. Despite years of foreign investments and a preferred, maverick founder giving it global publicity, it’s yet to successfully crack markets outside of its homeland.

Meanwhile, Sea continues its rise during the pandemic, partially due to strong e-commerce performance and partially to equally solid digital entertainment business which has also benefited from the lockdowns keeping legion people stuck reception.

In total, the corporation is on the point of cracking the US$10 billion revenue ceiling this year and its stock keeps beating records, having rallied ten-fold since 2019 and putting the present market capitalization at around US$170 billion, making it Singapore’s most precious enterprise.

Read also: What are the Online Marketplaces in the Philippines?

Want to Put Digital Ads Everywhere Without Hassle?

Get the 360 digital marketing experience via Ginee Ads. Put your ads anywhere at any time, do them all in just one place!

Chasing Amazon?

Shopee business model? Given this success, the question isn’t any longer whether Shopee can compete with regional rivals, but whether it can replicate its success elsewhere abroad.

So far, Amazon is actually the sole truly international e-commerce company. No other tech enterprise has managed to transcend borders quite as it has, but surely there must be space for a meaningful competitor to grow eventually.

So far, Chinese rivals are failing to form a dent, despite proximity to an outsized and cheap manufacturing base. Other online commerce clones have taken root in individual countries or regions but struggle to venture away from what they know best.

Shopee’s ease at combating much older and wealthier companies suggests that it should find success elsewhere too. The litmus test of its international ambitions goes to be its performance in geographic regions, where it’s already launched in Brazil, Chile, Colombia and Mexico.

Can Shopee Surpass the International E-Commerce Business of Alibaba?

Of course, Alibaba remains the number one company in China but despite years of foreign investment, it’s safe to mention the corporation has not successfully penetrated markets outside of its home country.

All while Sea continued to rise during the pandemic, partly thanks to the strong performance of e-commerce and partly due to the identical solid digital entertainment business, which also benefited from lockdown measures that kept ample people trapped reception.

Now what’s left for Shopee is to be ready to replicate its success elsewhere, abroad. The sole true international e-commerce company thus far has been Amazon. It’s true when experts claim no other tech enterprise has managed to transcend borders quite because it has.

Given Shopee’s ease at combating much older and wealthier companies, the Singapore born startup may find success elsewhere too. The sole thanks to know is to attend and see how its international ambitions are visiting play in the geographic region, where it’s already launched in Brazil, Chile, Colombia and Mexico.

Conclusion

Less than five years later, Shopee news had undoubtedly captured the lion’s share of the market when it conquered 57% of the whole Southeast Asian e-commerce market’s transaction volume. Its parent company by then was the most important tech company within the region and still is, with a market price of nearly US$173 billion.

Do You Want to Manage Multiple Marketplace Just by Single Person?

Of course you can! You can handle multiple stores from all marketplace just by single dashboard. Cut your Business’s cost, and Boost your Efficiency at the same time.

Managing Omnichannel Sales Data Too Difficult?

Data reporting feature from Ginee Philippines will help you manage and analyze all your marketplace stores data with just 1 click. You can easily check and download all your sale reports directly on Ginee and determine a sales strategy based on the report. Try it now, its free!

Ginee

Ginee

30-1-2022

30-1-2022