Important Notes

Ginee POS orders will also deduct your Order Quota

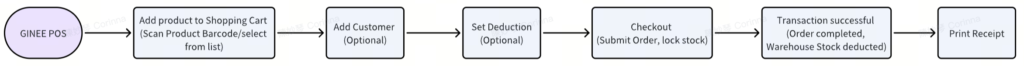

Checkout Process

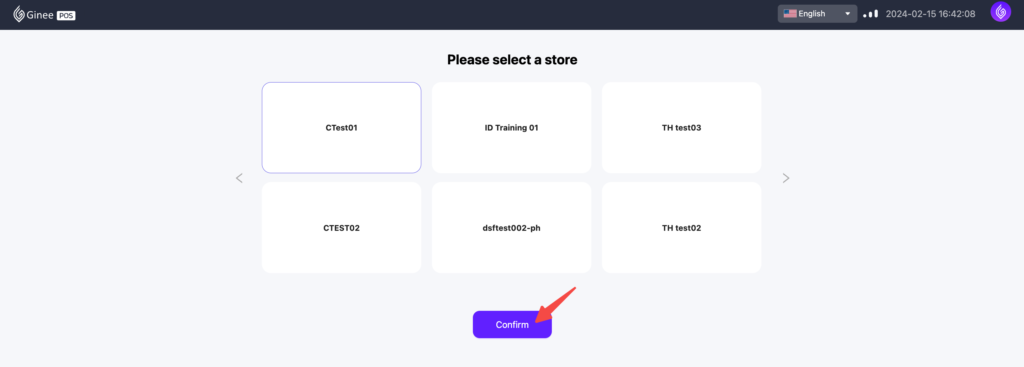

After logging in to Ginee POS (https://pos.ginee.com/), select the desired POS store > click Confirm

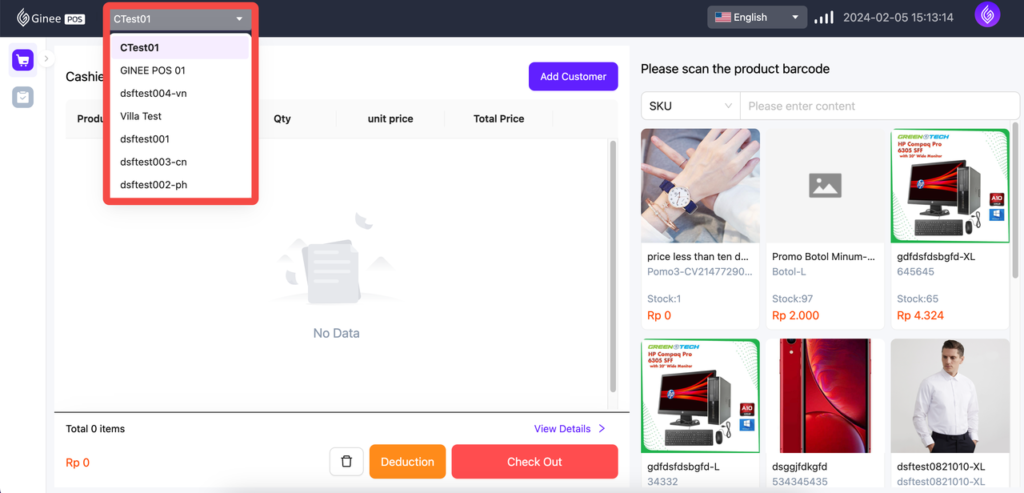

You can also change the store later

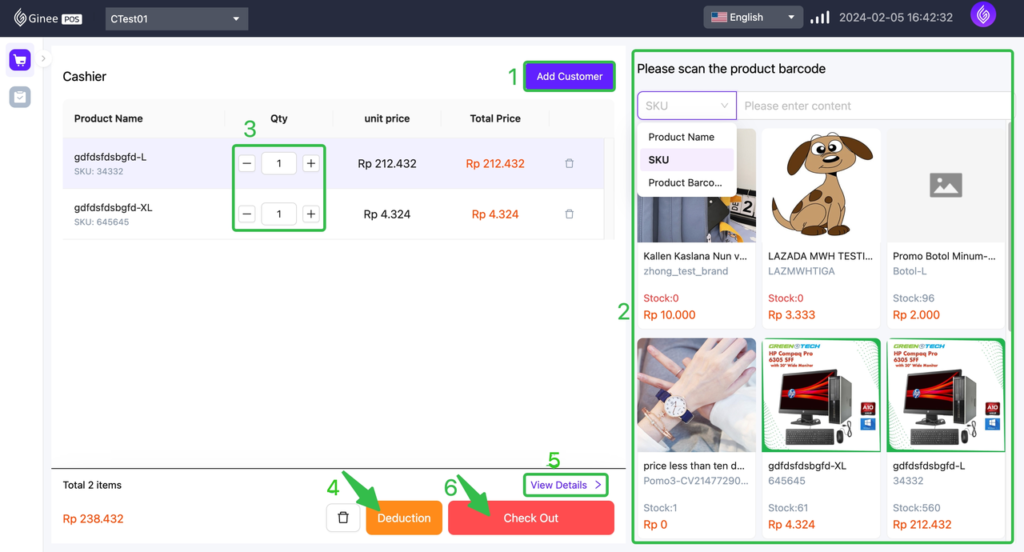

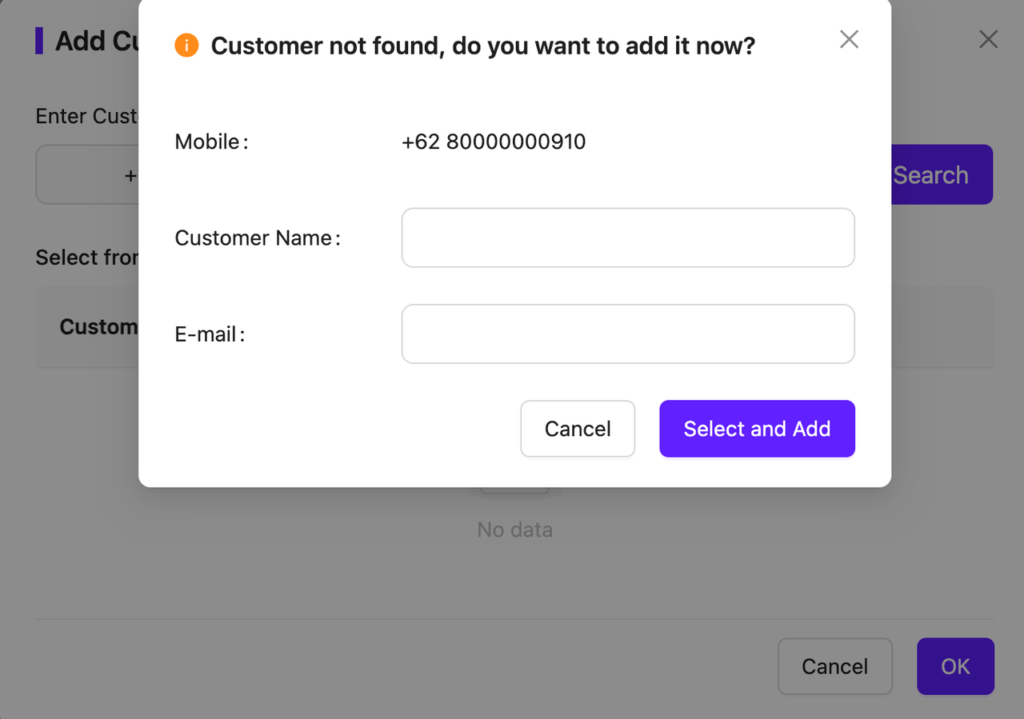

1. Add Customer (optional)

a. Search for an existing Customer by Phone Number

– Customer List is pulled from OMS

– Customer Phone Number will be censored in the middle

b. Create new Customer

Input Phone Number > click Search > Input Customer Name (optional) and E-mail (optional) > click Select and Add

2. Input products by scanning Product Barcode or fuzzy-searching Product Name, SKU or precise-searching Product Barcode

3. Set Product QTY (if the QTY is >1)

Can be operated by typing the QTY or clicking the same product or scanning the same product

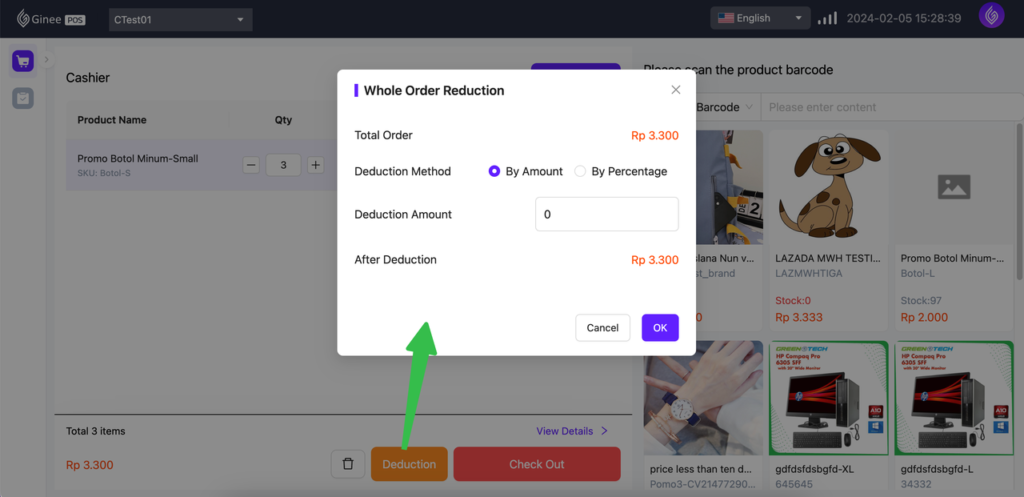

4. Click Deduction to set discount/deduction for the entire order (optional)

a. By Amount: Deduction/discount amount

b. By Percentage: Deduction/discount percentage, system will auto-calculate the amount

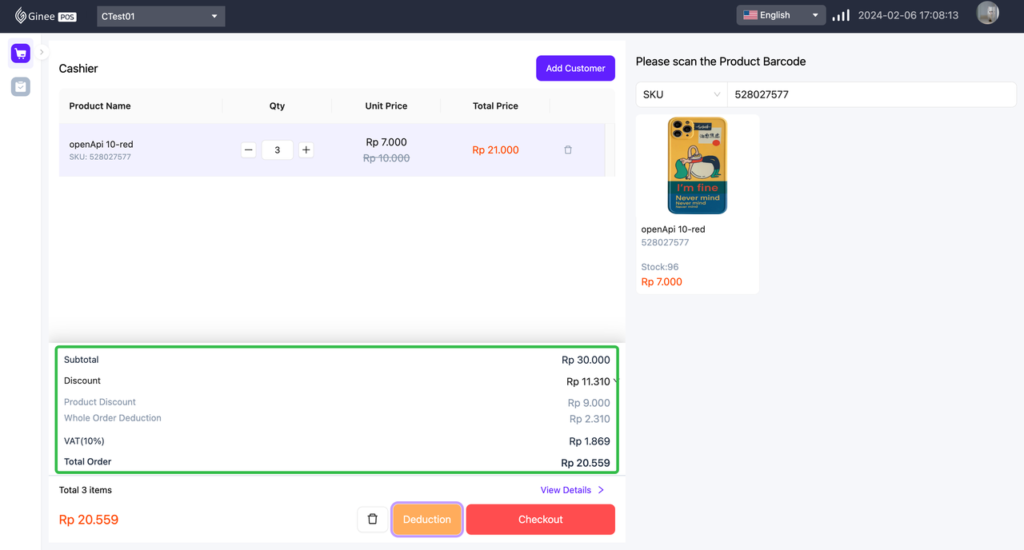

5. Click View Details to check the Order Details

– Product Subtotal: The sum of Total Price (Total Price = Unit Price*QTY)

– Discount: The sum of Product Discount and Whole Order Deduction (If there’s any)

– VAT: Tax amount based on the Tax Rate set in POS Setting (If there’s any)

– Total Order: Total final amount (Amount Due)

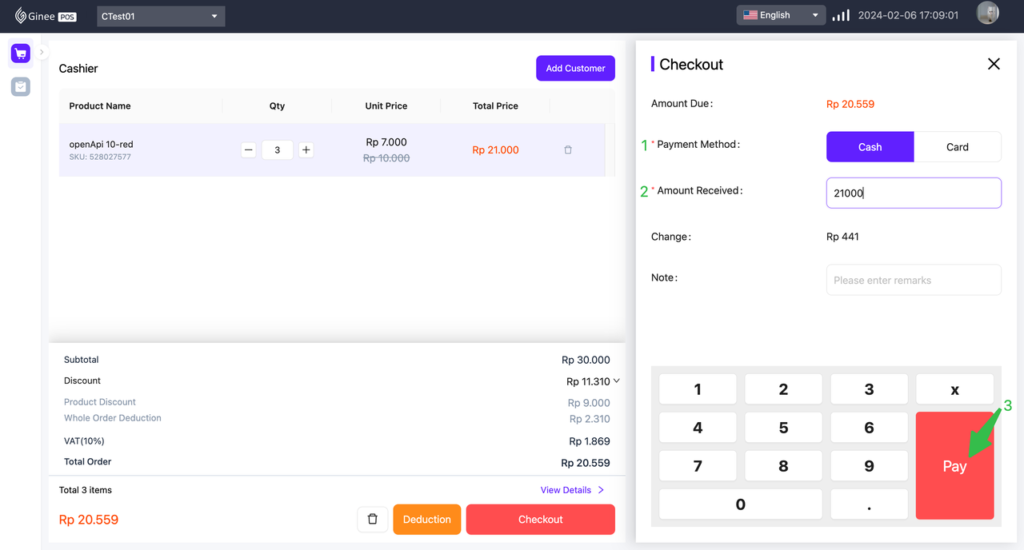

6. Click Checkout to proceed to payment

7. Select Payment Method (1) > Input Received Amount (2) > click Pay

System will auto-calculate the Change

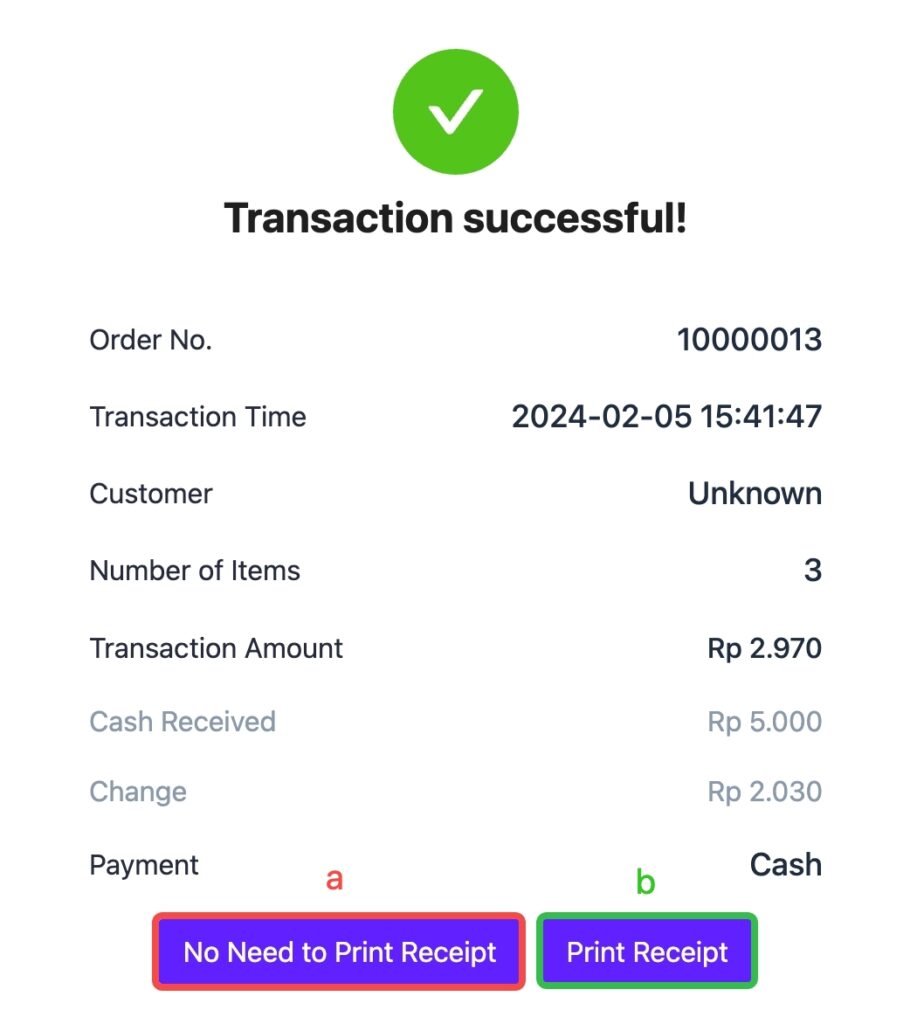

8. POS order created successfully

a. No Need to print Receipt: Checkout page will be opened

b. Print Receipt: to print the Receipt

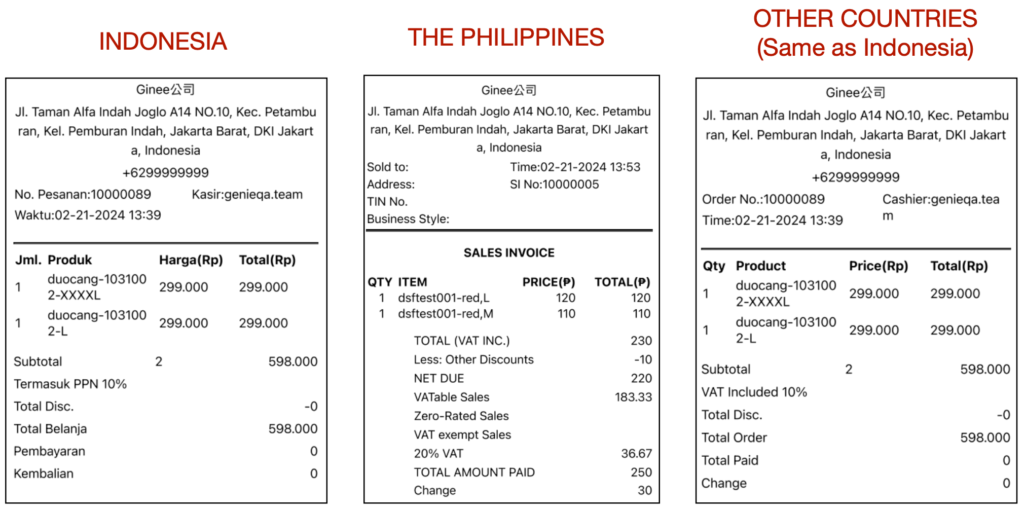

8.1. Receipt

– The template is 80mm paper size

– Is not customizable

– Indonesia, China, Thailand, Malaysia, Singapore and Vietnam are using the same template, while the Philippines template is using a different template

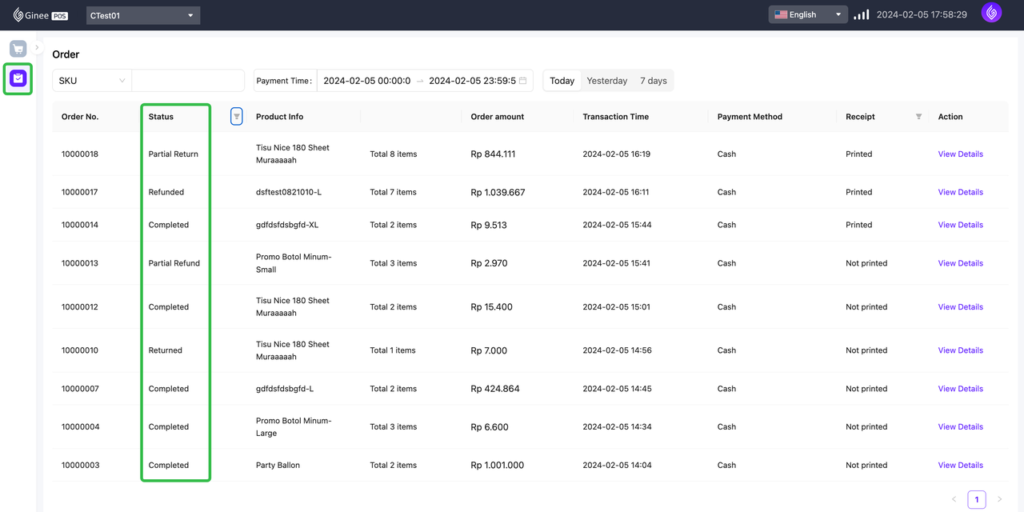

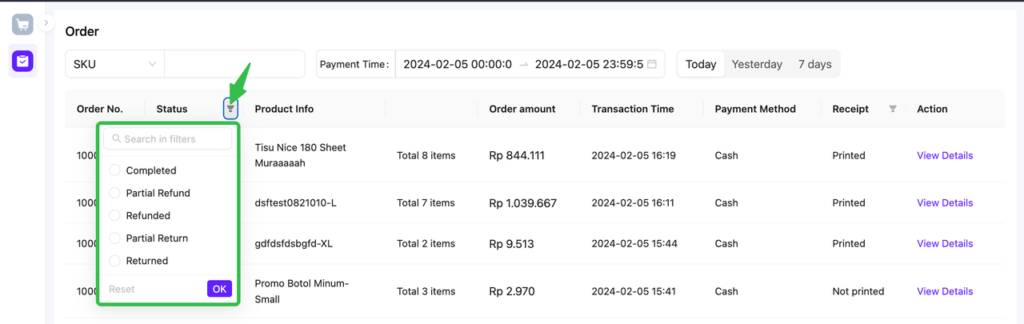

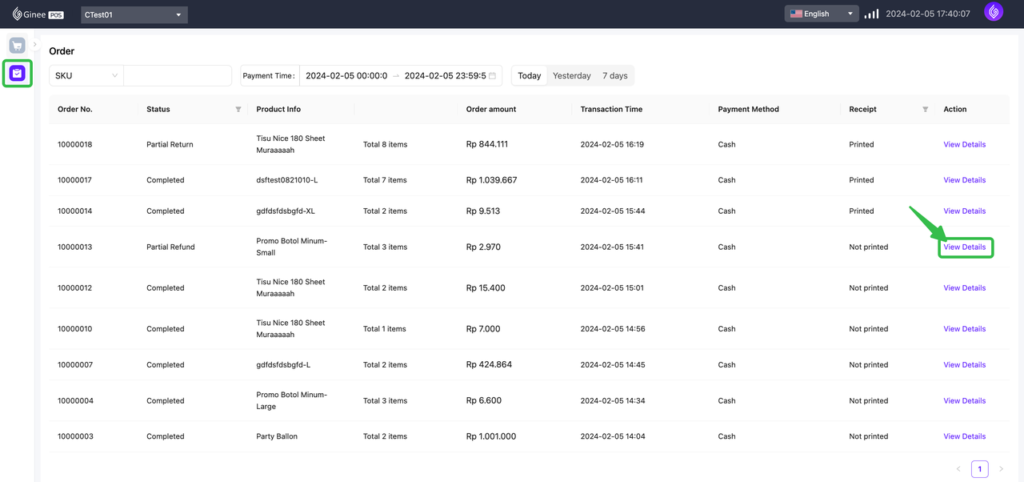

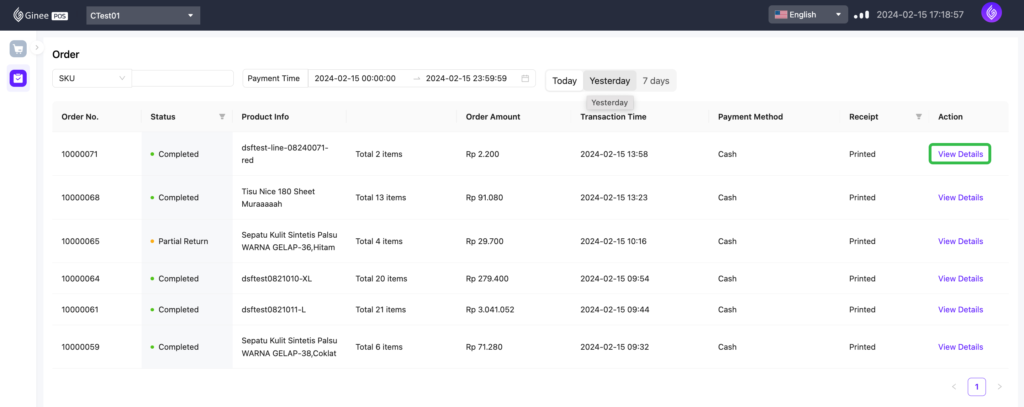

Order Status

1. Completed: Order completed, no Return or Refund at all

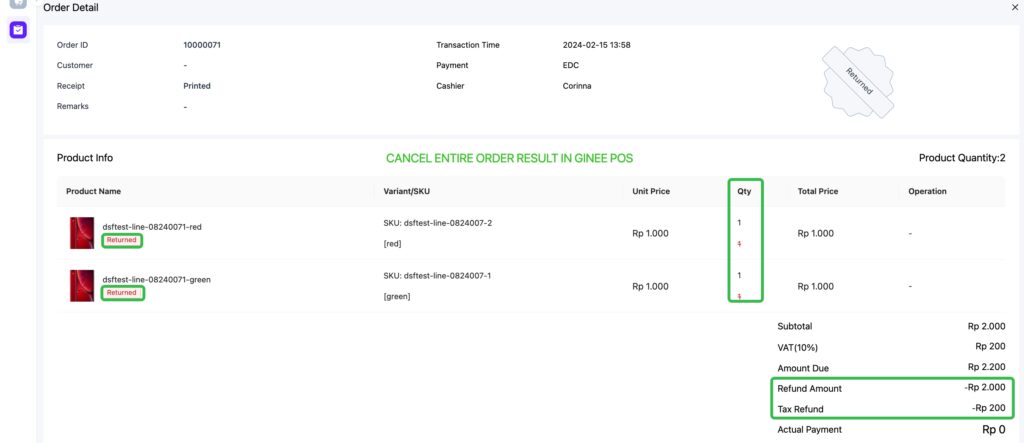

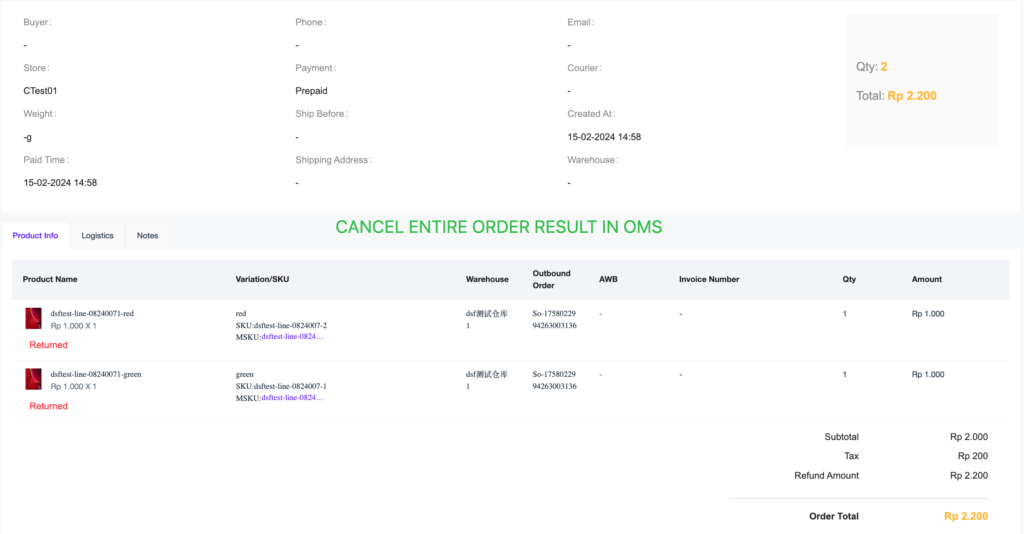

2. Returned: Products are fully returned (the entire order was cancelled)

3. Partial Return: Only some products are returned

4. Refunded: Products are fully refunded

5. Partial Refund: Only some products are refunded

Order Status can be filtered

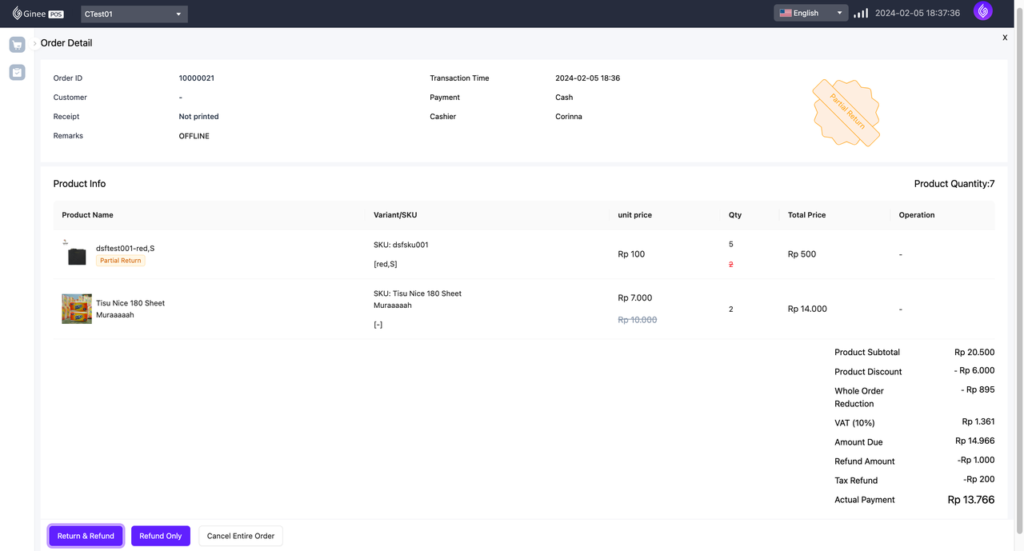

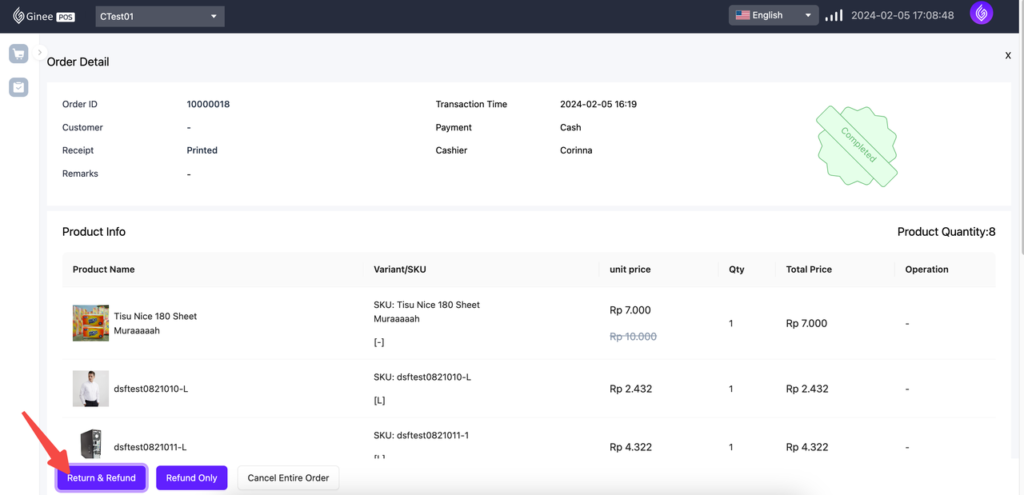

Order Details

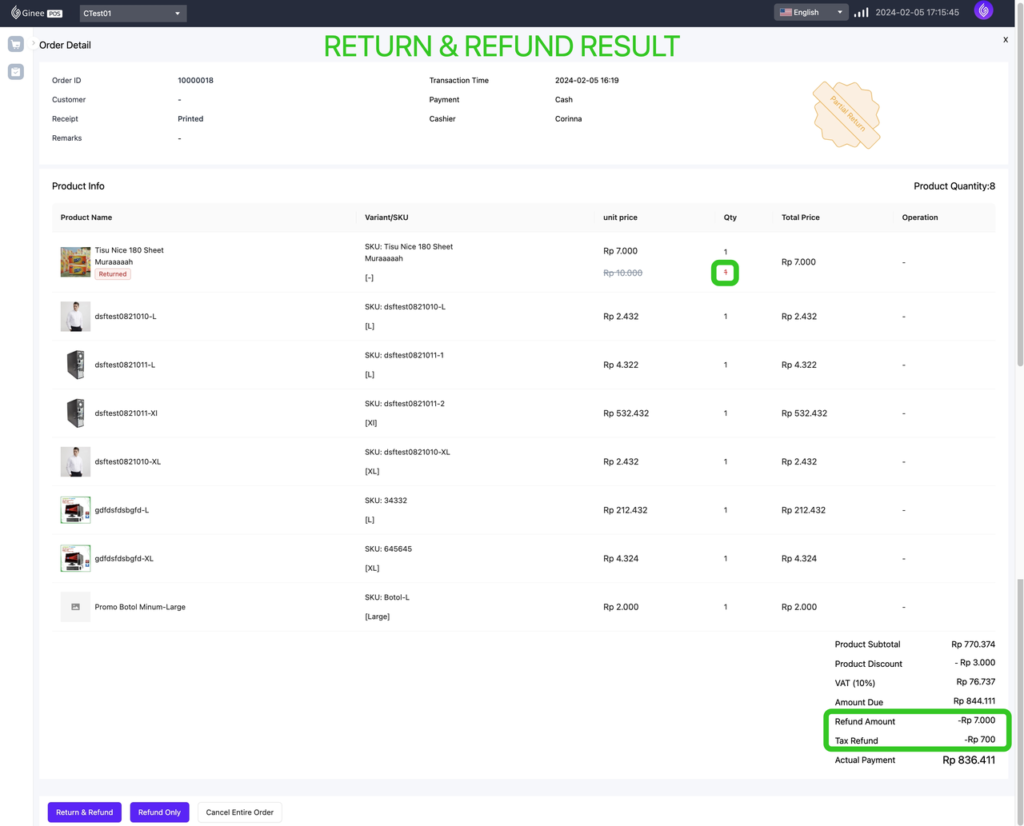

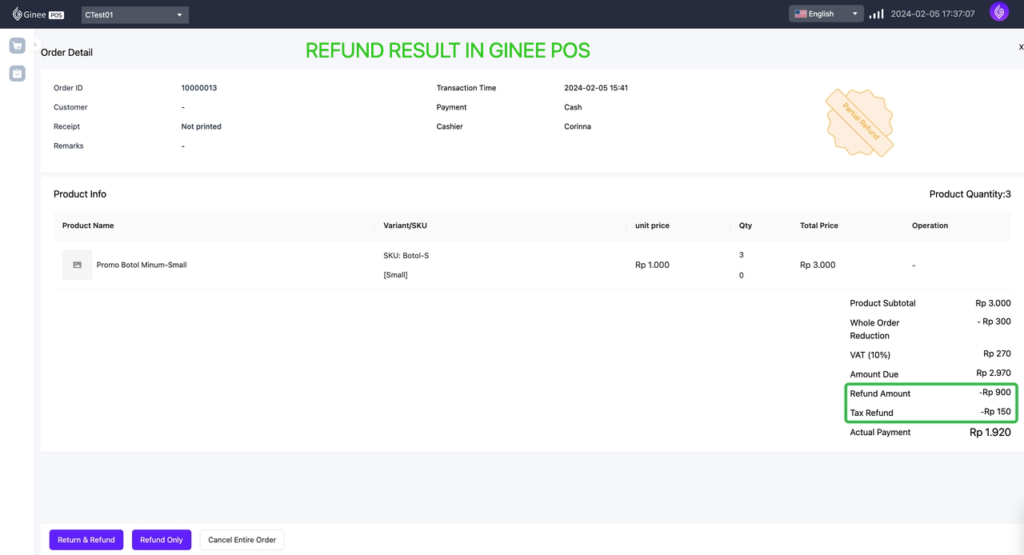

– Order Status

– Product Subtotal: The sum of Total Prices (Total Price = Unit Price*QTY)

– Product Discount: The sum of Product Discounts

– Whole Order Deduction: Deduction amount that was inputted

– VAT: Tax amount based on the Tax Rate set in POS Setting (If there’s any)

– Amount Due: Final order amount

– Refund Amount: Refund amount (If there’s any)

– Tax Refund: Tax Refund amount (If there’s any)

– Actual Payment: Final Received Amount (Actual Payment = Amount Due – Refund Amount – Tax Refund)

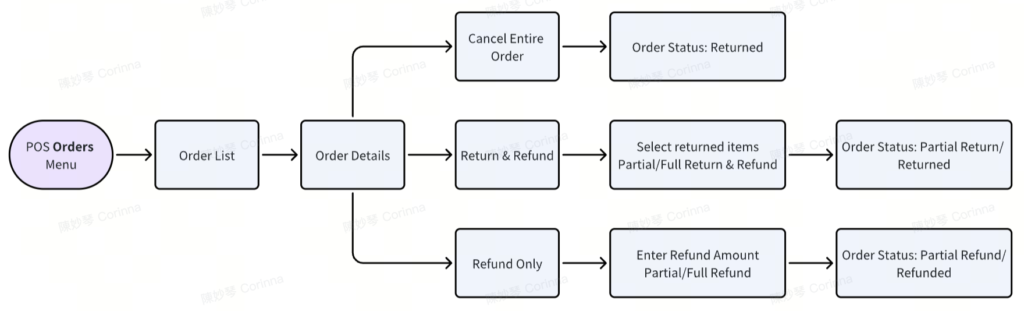

Order Process

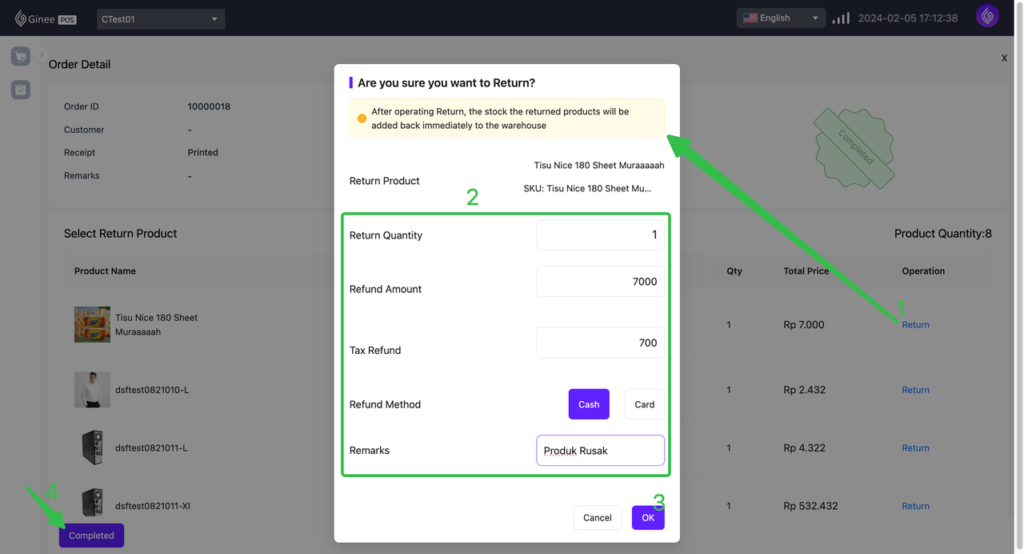

A. Return & Refund

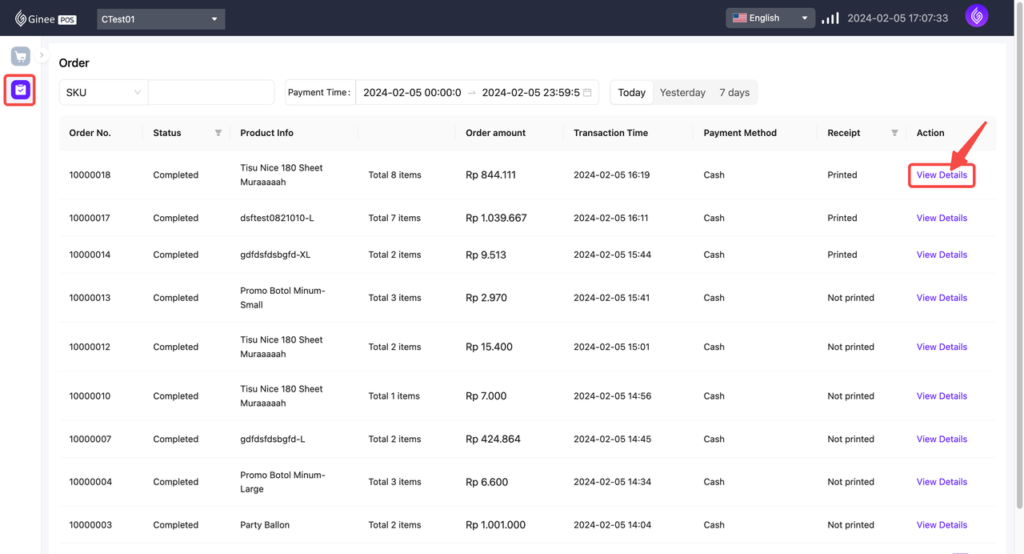

1. Go to Order > click View Details

2. Click Return & Refund

3. Click Return on the product you want to return > Input Return & Refund information > Click OK > Click Completed

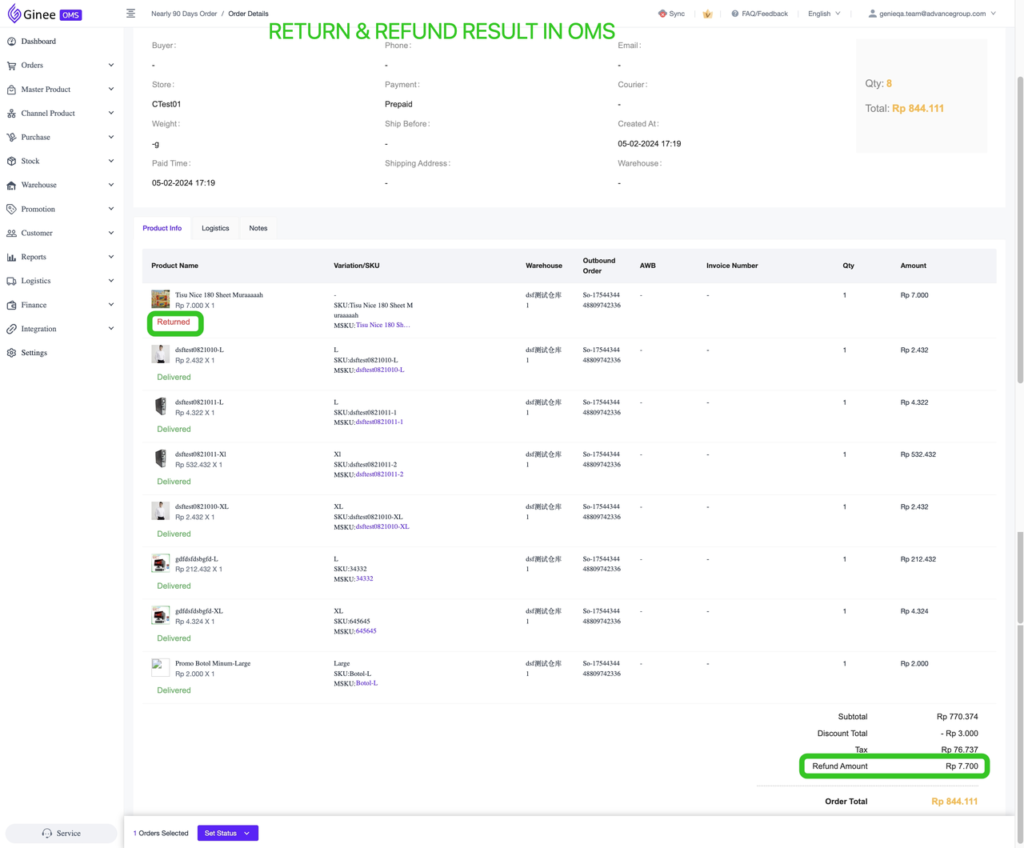

4. Return & Refund succeeded

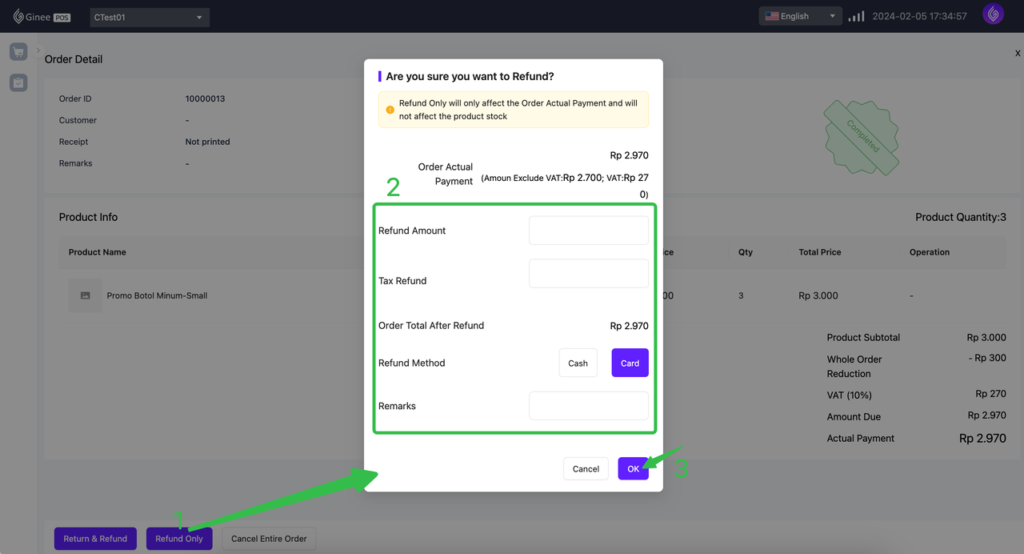

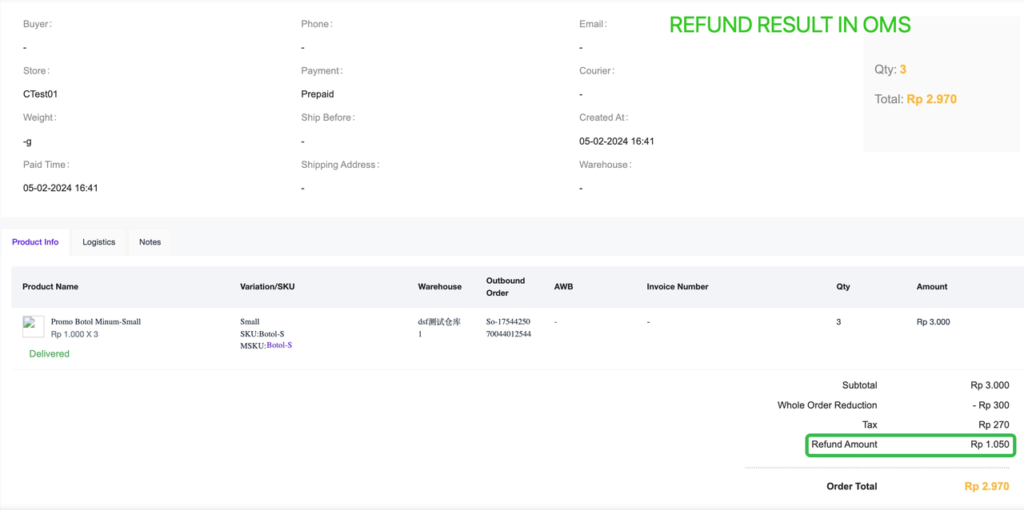

B. Refund Only

1. Go to Order > click View Details

2. Click Refund > Input Refund Information > click OK

3. Refund succeeded

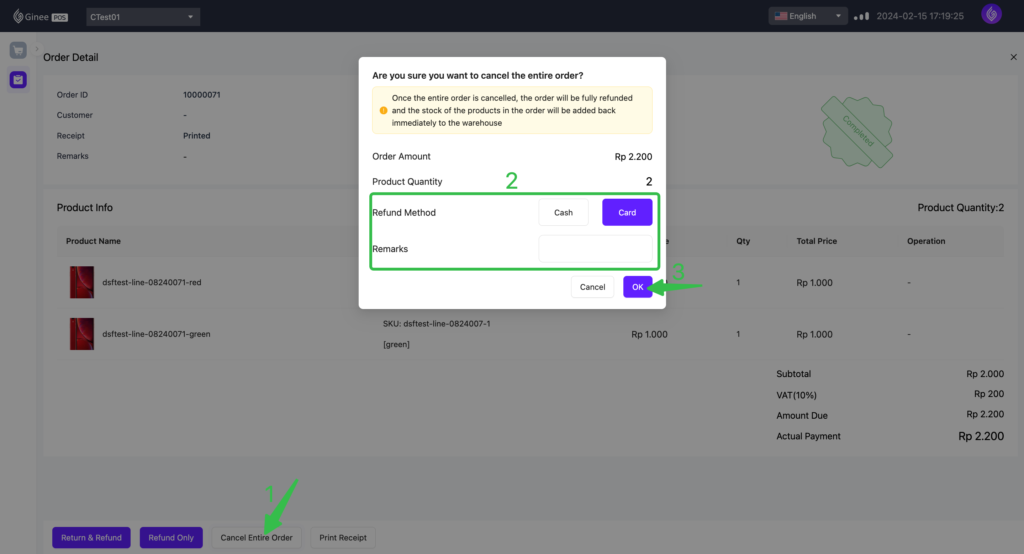

C. Cancel Entire Order (Equal to Return & Refund all items)

1. Go to Order > click View Details

2. Click Cancel Entire Order > Input Cancellation Information > click OK

3. Cancellation succeeded

To download the full guideline, please click Ginee POS Full Guideline

Ginee

Ginee

21-2-2024

21-2-2024